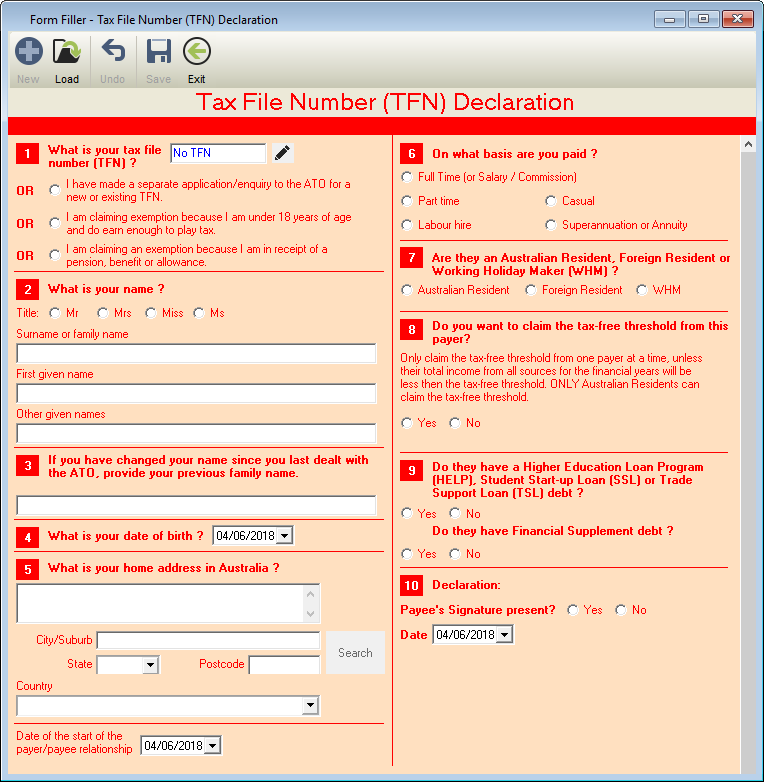

- New: Add a new TFN Declaration for the selected Employee

- Load: Load the Employees Information from Personal and Taxation in Employees.

- Undo: Undo any unsaved changes

- Save Save changes

- Exit: Close TFN Declaration window

- Section – to be completed by the PAYEE

- What is your tax file number (TFN)?: Imported from Taxation in Employees.

- What is your Name: Imported from Personal Information in Employees.

- If you have changed your name since you last dealt with the ATO, provide your previous family name: Manually entered by the user.

- What is your Date of birth?: Imported from Personal Information in Employees.

- What is your home address in Australia?: Imported from Personal Information in Employees.

- Date of the start of the payer/payee relationship: Imported from Employment in Employees.

- On what basis are you paid?: Imported from Employment in Employees.

- Are you an Australian Resident, Foreign Resident or Working Holiday Maker?: Imported from Tax in Employees.

- Do you want to claim the tax‑free threshold from this payer?: Imported from Tax in Employees.

- Do you have a Higher Education Loan Program (HELP), Student Start‑up Loan (SSL) or Trade Support Loan (TSL) debt?: Imported from Tax in Employees.

- Do you have a Financial Supplement debt?: Imported from Tax in Employees.

- Payees Signature present?: Ticked when the Employee has returned the physical TFN Declaration to you.

- Date: Date the physical TFN Declaration was signed and returned to you.

Revision:

14

Last modified:

Feb 15, 2021