THE INSTRUCTIONS BELOW ARE AN EXAMPLE ONLY AND ARE NOT A SUBSTITUTE FOR OBTAINING ADVICE. WE RECOMMEND TO CONTACT YOUR TAX PROFESSIONAL BEFORE SETTING UP ANY PAY RATES, ALLOWANCES OR DEDUCTIONS.

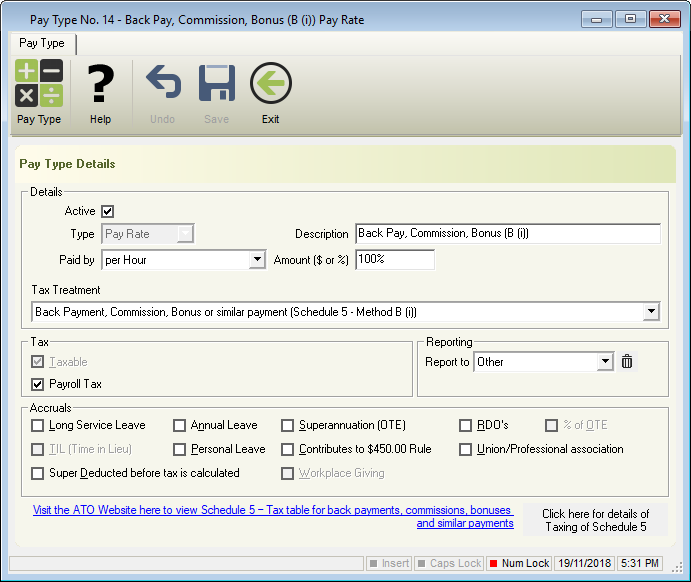

- Click Pay Types > New Pay Rate or

Click Pay Types from the Side Bar, Navigate to Pay Type, click on the drop-down menu and change to Pay Rate then click New. - Enter the Description.

- Select Paid by

- Per Day

- Per Hour

- Per Kilometre

- Per Lump Sum

- Per Month

- Per Pay Period

- Per Unit

- Per Unit – Punnet

- Per Week

- Enter the Amount ( $ or % ).

- If the employee is entitled to earn more super on this pay rate, enter the Superannuation % in Using Supr as set in the employees’ file instead of X.XX%.

- Select Back Payment, Commission, Bonus or similar payment (Schedule 5 – Method B (i)) in Tax Treatment.

- If required, change the following fields

- Tax

- Payroll Tax

- Reporting

- Report to

- Accruals

- Long Service Leave

- Annual Leave

- Superannuation (OTE)

- RDO’s

- Personal Leave

- Union/Professional association

- Super Deducted before tax is calculated

Before ticking Super Deducted before tax is calculated, please refer to your accountant or bookkeeper for advice.

- Tax

- Click Save then Exit.

Revision:

4

Last modified:

May 29, 2020