What are Concessional (Before Tax) Superannuation Contributions?

Concessional Super (Before Tax) Contributions are Salary Sacrifice payments, which an arrangement between the employee and employer to forego part (either percentage or dollar value) of their salary or wages in return contributing this amount into their super fund instead of receiving it as part of their net income. As these payments are deducted before tax is calculated, they will be taxed once the Superannuation Fund receives the contributions.

- Click Pay Types > New Deduction or

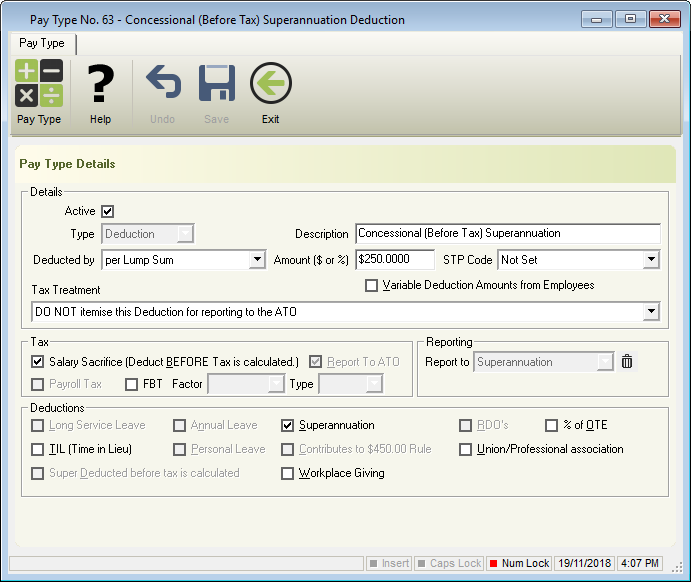

Click Pay Types from the Side Bar, Navigate to Pay Type, click on the drop-down menu and change to Deduction then click New. - Enter Concessional Super (Before Tax) into Description.

- Select Deducted by

- Per Lump Sum

- Per Month

- Per Pay Period

- Per Week

- Either enter the Amount ( $ or % ) if this Deduction is for a specific employee or select Variable Deduction Amounts from Employees and leave Amount ($ or %) blank if you wish to use this deduction for multiple employees.

- Leave STP Code as Not Set

- Select DO NOT Itemise this Deduction for reporting to the ATO in Tax Treatment.

- Select Salary Sacrifice (Deduct BEFORE Tax is calculated).

- Navigate to Deductions and select Superannuation.

- Change the following fields in Deductions if required.

- % or OTE

- TIL (Time in Lieu)

- Union/Professional association

- Workplace Giving

- Click Save then Exit.

- If the Employee earns Superannuation BEFORE the Concessional Deduction, you will need to

- Enter the Employee Superannuation Personal Contribution Details.

- Add the Deduction to the required Employee to load every pay run.

Revision:

28

Last modified:

Jul 20, 2022