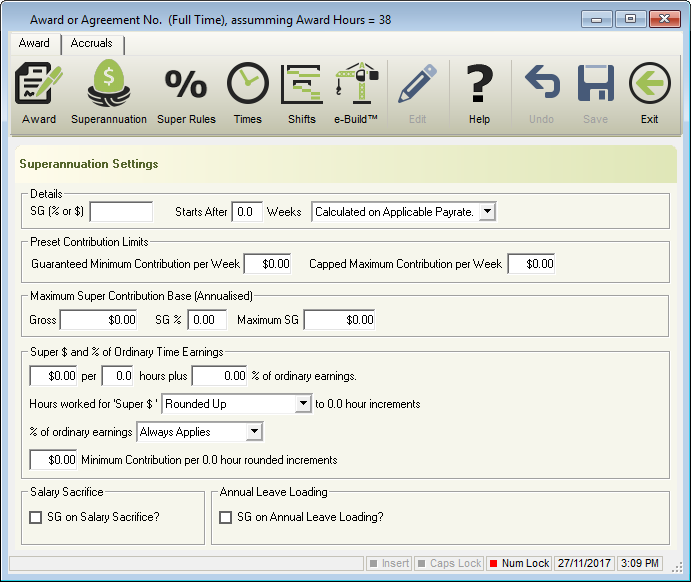

- Details

- SG ( % or $ ): % or $ entitlement for Superannuation.

- Starts After X Weeks: Where the entitlement for Superannuation starts only after a certain number of weeks.

- Calculated on Applicable Pay Rate: Superannuation will be calculated on any Pay Type which has Superannuation (OTE) ticked.

- Calculated on Base Award Rate: Superannuation will be calculated only on the Base award rate as set in Award or Special Award Rate.

- Calculated on Higher Pay Rate: Superannuation will be calculated only on the highest rate of pay.

- Calculated on Lower Pay Rate: Superannuation will be calculated only on the lowest rate of pay.

- Preset Contribution Limits

- Guaranteed Minimum Contribution per Week: Minimum Superannuation Contribution even if the calculated amount is less.

- Capped Maximum Contribution per Week: Maximum Superannuation Contribution even if the calculated amount is more.

- Maximum Super Contribution Base (Annualised). Learn more here.

- Gross: Annual Gross Salary before Super stops calculating.

- SG %: Set Superannuation %.

- Maximum SG: Calculated once Gross and SG % are completed.

- Super $ or % of Ordinary Time Earnings

- $XX.XX per XX.XX hours plus XX.XX% of ordinary earnings: Where SG (% or $) is not applicable for the total gross wages, a specific $ for Super per hour worked and a % of OTE can be set.

- Hours worked for ‘Super $’ X to 0.0 hour increments

- Rounded Down.

- Rounded Up.

- % of ordinary earnings

- Always applies.

- Only applied when rounded hours worked equals or exceeds 0.0 hours.

- $XX.XX Minimum Contributions per 0.0 hour rounded increments: Minimum $ of Super per 0.0 hour rounded increments.

- Salary Sacrifice

- SG on Salary Sacrifice: Indicates whether Super is applicable to be paid on the total gross (before salary sacrifice).

- Annual Leave Loading

- SG on Annual Leave Loading: Indicates whether Super is to be paid on Annual Leave Loading (17.50%).

Revision:

22

Last modified:

Dec 08, 2021