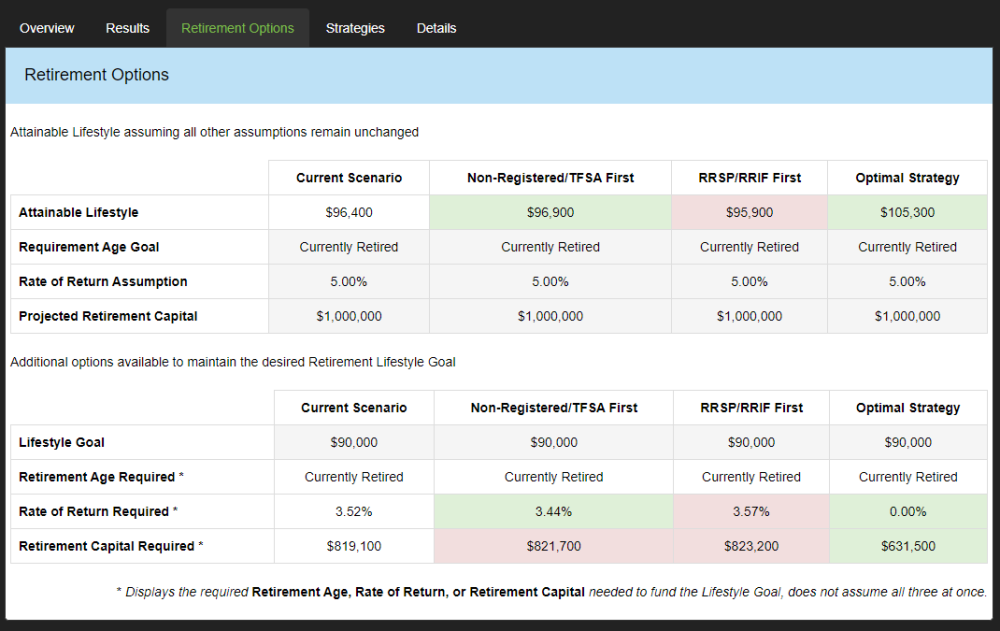

As part of the decumulation optimization, the software will also calculate the four Retirement Options for all three strategies and compare these results to the Current Scenario.

Strategies that out-perform the Current Scenario will be highlighted in Green. Strategies that under-perform the current scenario will be highlighted in Red. This screen will demonstrate the impact each strategy will have on the client’s retirement analysis.

The top section shows the difference in Attainable Lifestyle (retirement option #1) under the three decumulation strategies when the remaining retirement option settings are kept the same. This table shows how much the clients can spend from their retirement age to life expectancy under each strategy, these amounts are displayed in today’s dollars (after-tax).

The bottom section shows the difference in the remaining retirement options (Retirement Age, Rate of Return, Retirement Capital) under the three decumulation strategies when the lifestyle goal of the original scenario used in each of the scenarios. Each of these options are solved separately and are not related to each other, so the values shown for each retirement option is the result when the lifestyle goal is set to the value above it in this table.

Need more help with this?

Contact Razor Support