When the Pre-Retirement Cash Flow setting in Your Account is turned on, the program will classify pre-retirement income into Allocated and Unallocated. The unallocated income can then be managed using the Excess Cash Flow Management Tool provided in the program. To open this tool use the

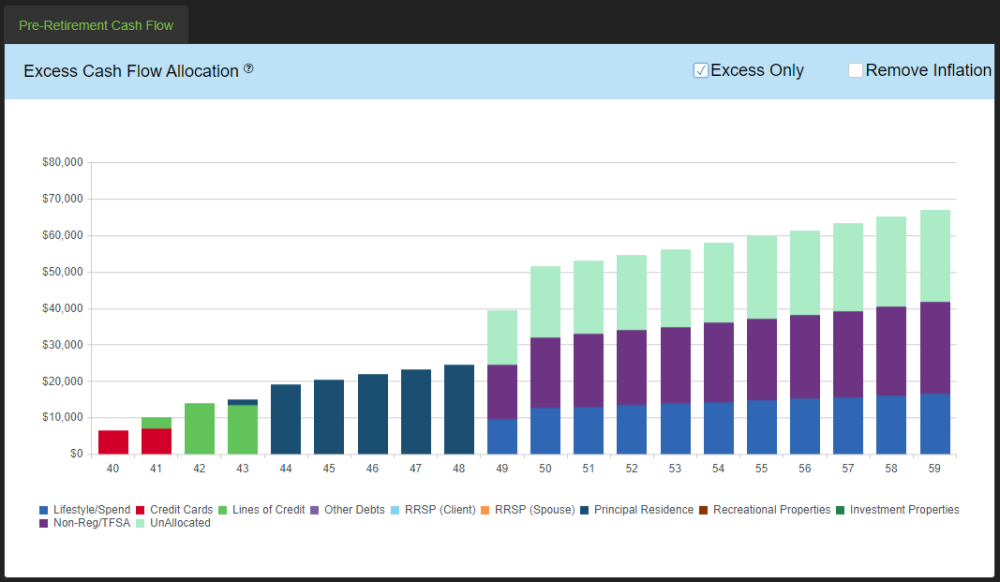

The Excess Cash Flow Allocation Chart is displayed when managing the excess cash flow in pre-retirement years. This chart provides a year-by-year breakdown of the cash flow excess for each of the pre-retirement years.

The way this chart displays is controlled by the checkboxes provided above the chart:

- Excess Only: Toggle the excess cash flow chart between displaying the excess income only and displaying allocated amounts along with the excess amounts.

- Remove Inflation: Toggle between displaying the excess amount indexed for inflation and removing the inflation from the excess to show amounts in today’s dollars.

Excess Cash Flow Management

The panel on the right hand side of the screen provides multiple options for managing the excess cash flow. The Excess Cash Flow Management Tool can be used to prioritized excess towards debts, allocate excess between debts and investments, and add excess to current lifestyle expenditures. To add to the prioritized debts, allocations or remainder use the button, then select an option from the drop down. To accept the new entry click the button or click the button to cancel the selection. To remove an option from being used in the cash flow management click the button.

- Prioritized debt to pay first: Prioritize the debts that will be paid down with any excess cash flow first. Debts will be paid off in the order entered until either all of the excess cash flow is used or the debt balance becomes zero. Once all debts selected in this section are paid off the tool will switch to allocation by percentage area. This area can be used to pay off the balances on Credit Cards, Lines of Credits, Other Debts, and mortgages on the Principal Residence, Recreational and Investment Properties.

- Allocation by percentage: Excess cash flow can be allocated to debts or investments using this area of the excess cash flow management tool. Once a debt or investment is selected, enter the percentage of the excess cash flow that is being allocated to the selected area. Excess cash flow will only be applied to the selected area if there are no prioritized debts or if all of the prioritized debts have been paid off.

- Remainder: Once prioritized debts have been paid and allocations have been applied, the Excess Cash Flow Management Tool can either spend or save any excess cash flow that remains. The remainder area can be used to deposit to Non-registered/TFSA accounts or add to the current pre-retirement lifestyle expenses.

The Excess Cash Flow Management Tool also provides an area for Lifestyle Spend Allocation which can be used to increase the planned lifestyle by a percentage of the excess cash flow at any age between the client’s current age and the planned retirement age. This increase in lifestyle expenditures takes precedence over all other areas and reduces the excess cash flow available to be paid on debts or allocated to savings.

Need more help with this?

Contact Razor Support