SIVI digital ecosystem

Within the financial services distribution, data and IT are increasingly preconditions for both the shaping of business activities (like acceptance of an insurance policy) and the development of customer services (for instance an insurance comparison site). The ultimate goal for SIVI is a dynamic and flexible ecosystem around digital business within the financial services industry.

A digital ecosystem:

• on the basis of shared principles;

• that is enabling chain parties to optimally support their customer in processes;

• where the various distribution models come into their own;

• where the use of open standards ensures

º cost reduction related to interoperability,

º making optimum use of market opportunities and

º the expression of individual differences;

• where, if using central or large-scale platforms, a well-established joint governance with regard to functionality and cost development is present;

• where necessary and relevant, joint agreements exist regarding transport, storage and processing of data;

• wherein the quality of authentication and security are sufficiently guaranteed.

Shaping a digital ecosystem (figure 1.3-1) within the financial services industry is leading for SIVI.

Customer: The Customer drives the digital ecosystem. A “private customer” (in the role of consumer or participant) or a “business customer”. The customer comes into contact with two domains within the digital ecosystem: data and distribution chain.

Data: Data is all about unlocking a large and diverse collection of data supplied by parties ranging from (semi) government to commercial organizations. Data can be about the environment (like KNMI, AHN), objects (like WOZ, Vehicle data), registration (like RDW, Land Registry), processes (like claim settlement), services (like accrued pension, claim-free years), telematics (like route covered, driving behavior), etc. The very wide spread of data means that data plays a role in all practical all financial services processes. With the increase in fully automated processes (STP) even a crucial role. The customer is in charge of a (limited) part of this data. He can consult data himself or have data consulted on his behalf with the appropriate authorization (as route traveled). In other situations, the customer has no control and (indicative) data is recorded and consulted about the customer (as the value of a house based on WOZ), what he does (as surfing behavior) and his immediate environment (as NAP level).

Distribution Chain: The main theme within the distribution chain it is about unlocking functions within processes. The customer carries out processes, asks to perform processes on his behalf (for example via intermediary or via administration office) or perform processes for him (for example by an insurer or by a repairer). When carrying out these processes, the parties involved frequently make use of services by third parties (like expertise or CIS). Suppliers of software and / or services support these processes as a whole or support process steps. As most chain parties do not develop systems themselves, suppliers play an essential role in shaping processes and the functioning of the chain.

Data often drives the functions and functions often unlock the data. No acceptance function without data, no demand for vehicle data without a premium function. With the increase in fully automated processes (autonomous applications), the importance of data becomes greater and therefore the link between these two domains becomes more strategic.

There is also a connection between private and business. With collective agreements (like a pension) the employer has a relationship with the participant. This can, for example, translate into roles within applications.

SIVI strives for a uniform digital ecosystem, not being necessarily a homogeneous digital ecosystem. Variation in interpretation can arise depending on the signature / positioning of chain parties. Chain parties can have different agendas such as:

• A small intermediary with a provincial portfolio.

• A service provider.

• A large regional underwriting agent.

The SIVI agenda therefore does not serve one specific solution direction. SIVI strives for preconditions within the sector that ensure that the various distribution models can come into their own within one digital ecosystem.

SIVI AFS

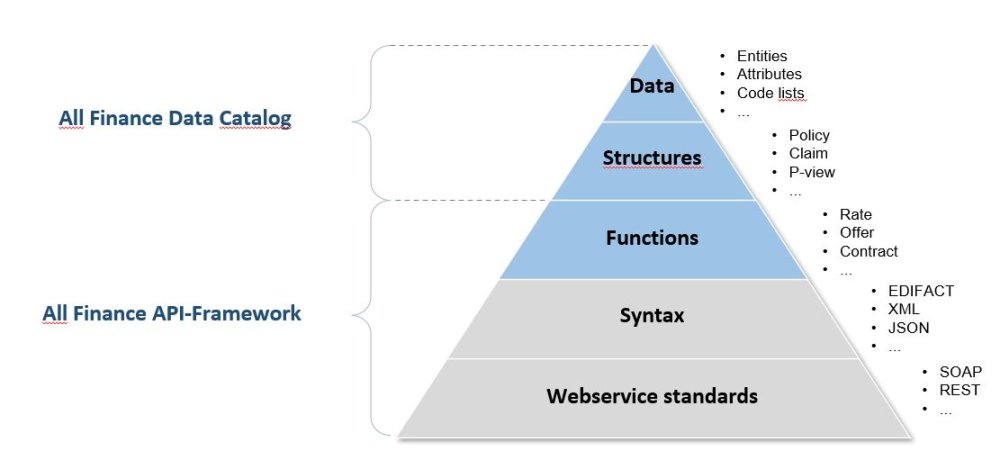

The objective of SIVI AFS is, that it forms the foundation of the envisioned ecosystem (figure 1.3-2). In blue the areas specific for the financial services domain. All data related agreements are documented within the All Finance Data Catalog. All agreements around functions and processes are documented within the All Finance API-framework.

The SIVI agenda for SIVI AFS can be summarized as:

Customer: Optimal customer service within the different distribution forms.

Data: Good access to data and possibilities to share data where necessary.

Distribution chain: Good interoperability within the chain with room for differences.

While addressing this agenda SIVI uses 5 principles as a guideline:

1. Focus on coherence of standards within the ecosystem.

2. Focus for easily deployable standards.

3. An eye for investments made.

4. Targeted support for both analyst and developer.

5. Connection to today’s technology.

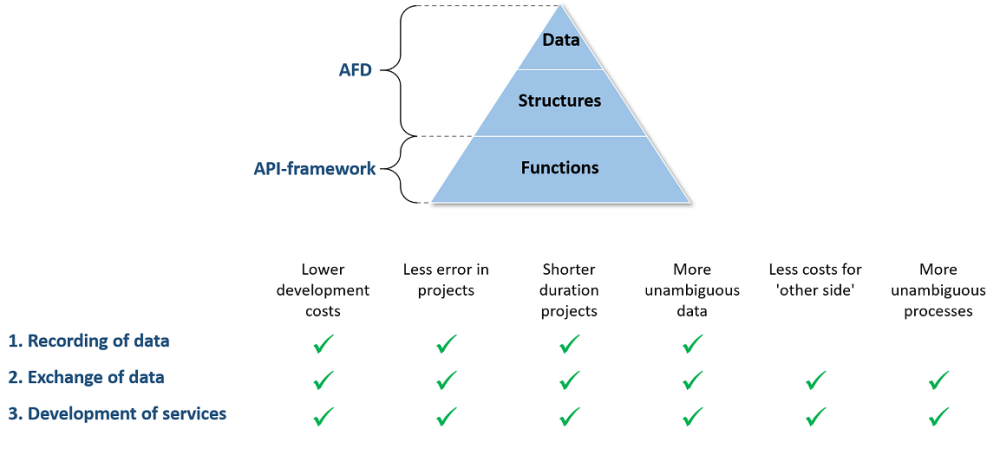

SIVI recognizes three perspectives with regard to modeling within the SIVI All Finance Standard:

1. Exchange of data.

2. Recording of data.

3. Development of services.

Specific benefits are identified per area. These benefits are taken into account in the development of SIVI AFS. In figure 1.3-3 an overview is listed.

The scope of SIVI AFS is very broad. Within the financial services domain it covers almost all branches (like general insurances, life insurances, pension, mortgage, loan, etc.) and many processes (like advice, quotation, application, change, claims, settlement, etc.). Two areas are explicitly excluded: the processes around claims handling for health insurance (www.vektis.nl) and payment transactions (www.betaalvereniging.nl). With regard to processes, the scope is all relevant processes between parties active in the distribution chain for financial services: primary chain parties (insurers, agents, service providers, etc.), third parties (repairers, experts, etc.) and suppliers.

Figure 1.3-4 shows an overview of the building blocks of SIVI AFS. The blue blocks are specific to the financial services industry. The yellow blocks provide, related to the use of SIVI AFS, guidance around the relevant generic standards. The green blocks depict principles used for the All Finance Data Catalog and the All Finance API-framework. The purple block represents the governance and maintenance of SIVI AFS.

As with the current SIVI standards, the development of SIVI AFS is demand-driven, the size and scope will develop over time. Anyone (chain parties, third parties and suppliers) can request a change / expansion, provided that it has a relationship with the financial services domain, or the implementation of related processes.

Future developments around SIVI AFS will include reference architectures for specific areas of application (such as premium calculation) in order to facilitate knowledge sharing. These reference architectures will show SIVI AFS objectives and form a starting point / reference point for own developments by individual parties. Points of attention will be:

• Setting up shared processes.

• Minimizing configuration activities around products (initial & ongoing).

• Minimizing the needed effort for chain tests.

Post your comment on this topic.