Tax Roll Creation

Before creating Tax Roll, BALANCE the Millage and Excise Board reports.

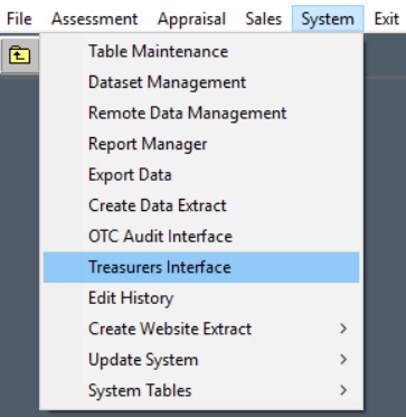

To create the Tax Roll to the Treasurer Main Menu — System — Treasurers Interface

The Transfer Utility box will open.

CHECK each box and make sure that the Treasurer’s correct software company is selected.

CLICK Continue and the new Tax Roll will be created in a new folder in the LandMark – Export Folder.

Typically, there will be three reports that are sent with the Tax Roll: Two different Property Totals Reports or Tax Roll Abstracts (Tax Area and District) and the Escrowed Tax Report.

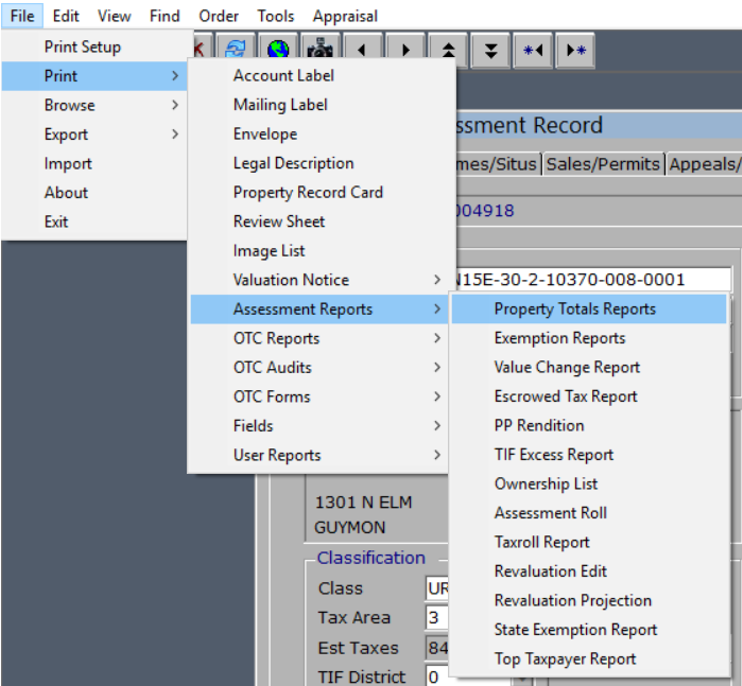

To run the Property Totals Report

Parcel File — File – Print – Assessment Reports – Property Totals Reports

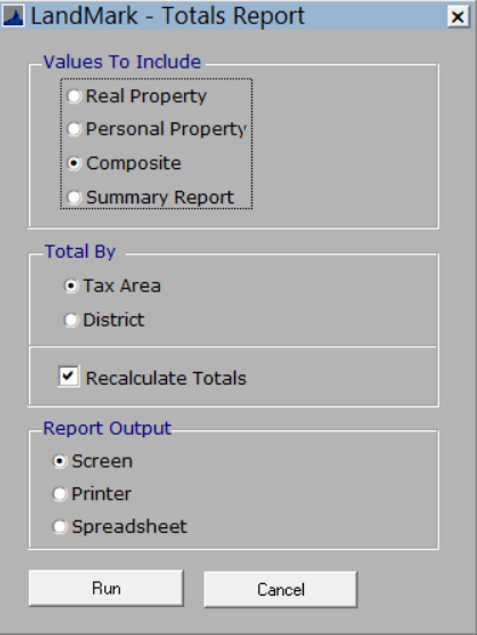

This will open the Totals Report box.

Values to Include should be set as Composite.

RUN one Total By Tax Area and another Totals By District.

The first time the Property Totals Report is ran Users should Recalculate Totals.

RUN the report to the screen

SAVE the file in the 2022TaxRoll Folder that was created when the new Tax Roll was run.

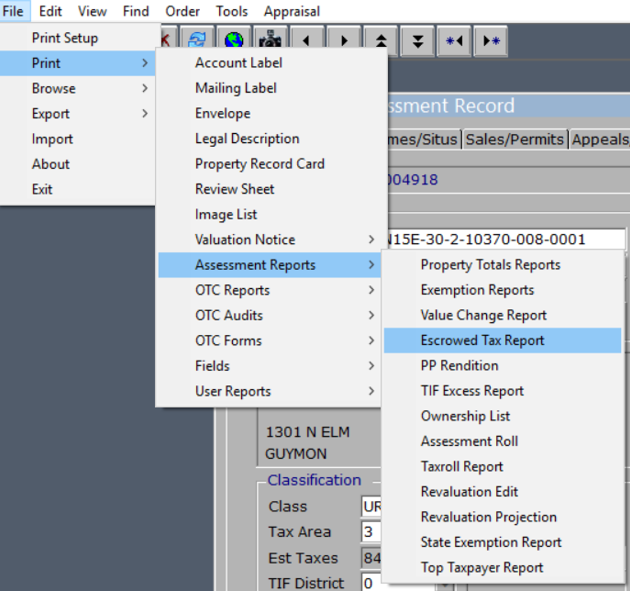

RUN the Escrowed Tax Report

SAVE that report into the same 2022TaxRoll file

Once each report is run and saved in the file, the 2022TaxRoll file is complete and can be sent to the Treasurer.

Post your comment on this topic.