The Working Year is the year the county is CURRENTLY valuing. When updated it adds another year of depreciation and changes the year for new construction.

MANY things can go wrong if the county changes the Working Year too soon. If county changes the Working year BEFORE protests are over (before they are ready to start their revaluation process), the appraisal side will add another year of depreciation—making it difficult settling a value.

Example: If the working year is 2023, but, user is entering things for next year (while waiting until protests are over to change the working year), they will have to put the new construction year in for 2024.

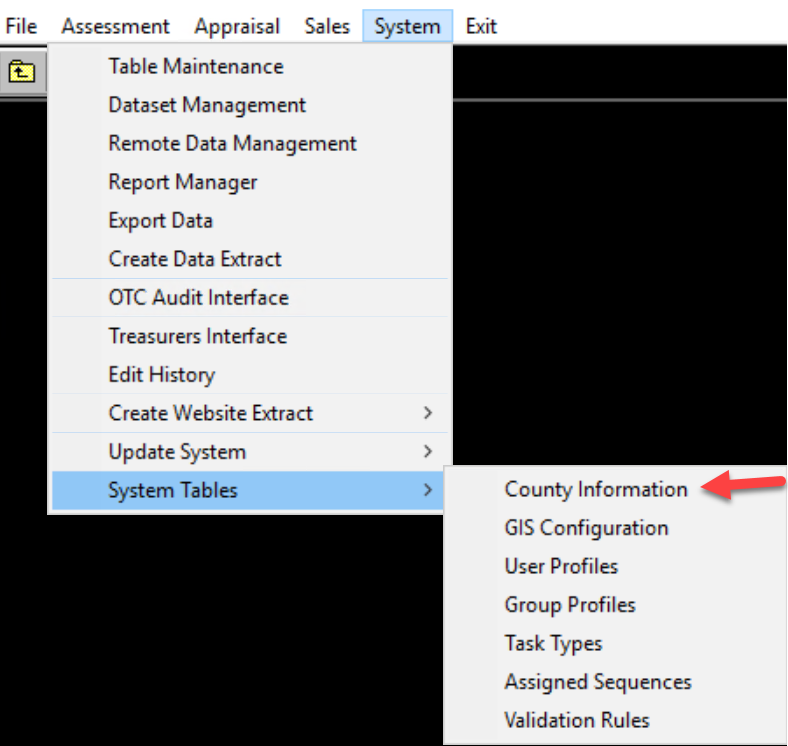

Main Menu —System — System Tables — County Information

The County Information File will open.

CLICK on Assessors Setup Tab

CLICK the Edit Button

CHANGE the Working Year

EXIT and SAVE changes

Post your comment on this topic.